1. What is Pension Auto-Enrolment?

All employers must provide a workplace pension scheme whether public or private sector, this is called ‘automatic enrolment.’ Your employer must automatically enrol you into a pension scheme and make contributions to your pension if all of the following apply:

• you’re aged between 22 and state retirement age

• you earn at least £10,000 per year

• you usually (‘ordinarily’) work in the UK

This will happen when you join any HSCNI organisation automatically.

2. What Pension scheme/s will I be automatically enrolled into?

The 2 pension schemes used by HSC employees are:

• HSC Pension Scheme.

• NEST Pension

3. Why have I been put into a pension scheme?

All employers now have to put their workers into a pension scheme if they earn over £10,000 per year, are aged 22 or over and are under state pension age. This is the law, because the government wants to get more people to have another income in addition to the state pension when they retire.

4. How is it determined which pension scheme I am enrolled into?

The majority of individuals will be enrolled into an HSC pension scheme. However, you will be enrolled into NEST if the following applies:

a. You are already in receipt of a 1995 Section HSC pension.

b. You are in the HSC pension in another post up to full time, and this additional post has earnings that exceed £10K per annum.

c. You are under age 75.

5. How do I leave the scheme?

If you don’t want to join the scheme, you need to ask to leave it. You can choose to leave the scheme in the one month period from the date you were put in. You do this by completing the leaving the scheme form available from the website addresses below:

➢ HSC Pension Scheme: Leaving the Scheme – HSC Pension Service (hscni.net)

➢ NEST Pension Scheme: www.nestpensions.org.uk

Both forms should be submitted to the PSC Contact Team for action by the payroll

service centre. See link below to the Payroll Query Form.

https://payrollquery.hscni.net/

If you leave the scheme during this period any money you have already paid into

your pension may be refunded and you won’t have become a member of the scheme

on this occasion.

If you want to stop paying into your pension after the end of this one month period

you can. The money you have already put in should be refunded, however this may

vary depending upon which pension scheme you have been placed into and for how

long you have been paying into it.

6. What if I ask to leave the scheme but then change my mind in the future?

You can ask to re-join the scheme at any time by completing the relevant forms

found on the website addresses below and submitting to the following web link:

https://payrollquery.hscni.net/

HSC Pension Scheme: Joining the Scheme – HSC Pension Service (hscni.net)

NEST Pension Scheme: www.nestpensions.org.uk

7. If I ask to leave the scheme, what happens after that?

Anyone who asks to leave, or stops paying into, the scheme will be put back into it at

a later date (usually every three years if they meet certain criteria) in line with the

rules of pension auto re-enrolment. We will contact you when this happens and if

you wish you can ask to leave the scheme again as set out in the questions above.

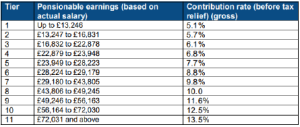

8. If I stay in the scheme what % of pension will I pay?

You will pay a % of your pensionable earnings each pay period. This varies

depending on the scheme you have been enrolled into. See the tables below for

both schemes and the relevant earnings thresholds for each of the pension

contribution tiers.

If you are enrolled into the HSC Scheme, your % of contribution will be reassessed

on a monthly basis in line with all other HSC employees.

HSC Pension Scheme

Contributions Rates 1 November 2022 – Present:

The employer contribution rate for all HSC schemes is currently held at 22.5%.

NEST Pension Scheme

The rates payable for the NEST Pension Scheme are set and do not fluctuate with earnings.

| NEST | Employee Contribution rate | Employer Contribution rate |

| 5% | 3% |

Pension Re-enrolment

9. What is Pension Re-enrolment?

Whilst employees will be auto enrolled into a Pension scheme upon joining a HSCNI organisation, they may choose to opt out, as covered in Questions 1-8.

There is a legal obligation of the employer to re-enrol employees to the pension scheme after a 3-year period. As this is a legal requirement, PSC will undertake this work in line with requirements and you will be advised when this happens by letter.

10. How often does this happen?

This happens every 3 years within a 6-month date range stipulated to each employer by the Pension Regulator. This will vary from employer to employer even across each of the HSC employing organisations.

11. Who will be assessed?

Any employees who are not an active member of a pension scheme at the date of assessment. The criteria in which you will be are assessed is the same as auto-enrolment. These are:

• you’re aged between 22 and state retirement age

• you earn at least £10,000 per year

• you usually (‘ordinarily’) work in the UK

12. Will anyone be excluded from the being re-enrolled?

Yes, there are specific circumstances when employees will not be re-enrolled to a pension scheme as below:

a) The employee has opted out of the pension scheme within 12 months prior to the date of assessment.

b) The employee is absent from employment due to sickness on the date of assessment.

c) The employee does not meet the criteria as set out in question 11.

13. How is it determined which pension scheme I am enrolled into?

The majority of individuals will be enrolled into an HSC pension scheme. However, you will be enrolled into NEST if the following applies:

a) You are already in receipt of a 1995 Section HSC pension.

b) You are in the HSC pension in another post up to full time, and this additional post has earnings that exceed £10K per annum.

c) You are under age 75.

14. How do I leave the scheme?

If you don’t want to join the scheme, you need to ask to leave it. You can choose to leave the scheme in the one month period starting on either the date of the letter received from the PSC to advise of your re-enrolment, or the date you were put into the scheme, whichever is the latest. You do this by completing the Leaving the Scheme form available from the website addresses below:

HSC Pension Scheme: Leaving the Scheme – HSC Pension Service (hscni.net)

NEST Pension Scheme: www.nestpensions.org.uk

Both forms should be submitted to the PSC Contact Team, using the Payroll Query Form for action by the payroll service centre.

https://payrollquery.hscni.net/

If you leave the scheme during this period any money you have already paid into your pension may be refunded and you won’t have become a member of the scheme on this occasion.

If you want to stop paying into your pension after the end of this one month period you can. The money you have already put in should be refunded, however this may vary depending upon which pension scheme you have been placed into and for how long you have been paying into it.

15. What if I ask to leave the scheme but then change my mind in the future?

You can ask to re-join the scheme at any time by completing the relevant forms found on the website addresses below and submitting to the following web link https://payrollquery.hscni.net/

HSC Pension Scheme: Joining the Scheme – HSC Pension Service (hscni.net)

NEST Pension Scheme: www.nestpensions.org.uk

16. If I ask to leave the scheme, what happens after that?

This cycle of re-enrolment continues to happen every 3 years while you are an employee and meet the criteria of re-enrolment.

Business Services Organisation

Business Services Organisation