Content Migration required

Electric and Leased Vehicle Mileage Claims

PSC has updated HRPTS to enable some changes for leased mileage claims.

These are as follows:

- Employees with electric leased vehicles to claim mileage from the following dates:

- AFC electric leased cars – from 1st April 2017

- M&D electric leased cars – from 1st April 2020

- M&D electric non leased cars – from 1st April 2020

These employees should now from immediate effect be able to claim on the system.

2. The Department of Health, in February 2023, issued a circular introducing new rates for leased vehicle owners from 1 April 2023 as shown in the table below. These rates will be reviewed and updated quarterly in line with the DoH circular for fuelled vehicles. Electric rates will be updated in line with the HMRC Advisory Electric Rates.

| Type of Vehicle Leased via the HSC Scheme with NHS Fleet Solutions | Rate to 31st March 2023 | Rate as of 1st April 2023 | Rate as of 1st June 2023 | Planned rates as of 1st September 2023 | ||

| First 3,500 miles per annum | Above 3,500 miles per annum |

All miles claimed |

All miles claimed |

All miles claimed |

||

| Agenda for Change Employees | Private Lease of all Fossil Fuel Types Including Hybrid | 56ppm | 30ppm | 15.6ppm | 14.2ppm | 13.8ppm |

| Private Lease of a Wholly Electric Car | 56ppm | 30ppm | 9ppm | 9ppm | 9ppm | |

| Business Lease of All Fossil Fuel Types including Hybrid | 17.2ppm | 17.2ppm | 15.6ppm | 14.2ppm | 13.8ppm | |

| Business Lease of a Wholly Electric Car | 17.2ppm | 17.2ppm | 9ppm | 9ppm | 9ppm | |

| Medical & Dental Employees | Private Lease of all Fossil Fuel Types Including Hybrid | 56ppm | 30ppm | 15.6ppm | 14.2ppm | 13.8ppm |

| Private Lease of a Wholly Electric Car | 56ppm | 30ppm | 9ppm | 9ppm | 9ppm | |

| Business Lease of All Fossil Fuel Types including Hybrid | 17.8ppm | 17.8ppm | 15.6ppm | 14.2ppm | 13.8ppm | |

| Business Lease of a Wholly Electric Car | 17.8ppm | 17.8ppm | 9ppm | 9ppm | 9ppm | |

To note – Employees had been advised not to claim leased car mileage from the 1st April 2023 to enable PSC to implement the changes to the system to support the circular. However we have identified claims made during the period Apr 2023 to July 2023 and therefore these employees will have been overpaid. PSC will review claims made and seek recovery of overpayments in line with the regional overpayments policy.

What is a P11D?

P11D FAQs

What is a P11D?

The P11D is a statutory form required by HMRC from all UK based employers detailing the cash equivalents of benefits and expenses that they have provided during the tax year to their employees.

HMRC will use the information supplied on this form to assess the taxable benefit charge and amend your tax code accordingly. HMRC will issue a P800 Notice to the employee informing them of this change, HMRC will send your new tax code electronically to PSC who will apply the new tax code to your payroll record once it is received.

Please note that PSC cannot not change such notifications and it is your responsibility to query your tax code with HMRC should you believe it to be incorrect.

When is a P11D filed?

Your employer must complete and submit all P11D forms to HMRC by 6th July following the tax year in question. So, for example, your P11D for the tax year running April 2022 to April 2023 must be filed by 6th July 2023. Form P11D will be posted to employee’s home address as recorded on HRPTS by this date.

Can I access my P11D in HRPTS?

Unfortunately, for the 2022/23 tax year this is not possible.

However, PSSC is currently working with our supplier to bring this functionality in the future.

What is included in a P11D?

Generally speaking, any items the company pays for that the employee benefits from need to be included on the P11D form. Expenses and benefits that need to be recorded include:

- Section A – Assets Transferred

- Section B – Payments made on behalf of the employee

- Section C – Credit Cards and vouchers

- Section D – Living Accommodation

- Section E – Mileage Allowances

- Section F – Cars and car fuel

- Section G – Company Vans

- Section H – Beneficial Loans

- Section I – Medical Health

- Section J – Qualifying Relocation Payments

- Section K – Services Supplied

- Section L – Assets placed at employee’s disposal

- Section M – Other Items

- Section N – Expenses Payments

Please be advised form P11D is not issued to employees with no taxable benefits and/or expenses for the year.

What does HMRC’s term Company Car mean?

HMRC define the term company car as a car made available, without the employee becoming the outright owner, by reason of their employment.

It can refer to a car supplied automatically by an employer

Or

The scenario when someone takes up the option of giving up the right or future right to receive earnings in return for a benefit i.e. a lease car.

How much Car Benefit Tax will HMRC charge?

The amount of car tax an employee will pay is dependent on the following bullet points:

- Date car first registered

- List price of the vehicle

- CO2 emissions figure

- Fuel type

- No of days availability in year

- Monthly deductions from the employee’s net salary (Only applicable to those on the Salary Deduction Schemes)

- From April 2017, employees on the Salary Sacrifice contracts will pay the greater of the amount of cash sacrifice given up and the taxable value under the normal calculations.

- OpRa scheme

Calculation can be shown as follows:

([List Price of the vehicle] x [the appropriate HMRC percentage] x [availability days])

LESS

(Private Use Contributions made by the employee i.e. Deductions made out of Net Pay, however this is only applicable to those on the deductions schemes)

(Salary Sacrifice Scheme) Do I make private contributions towards my car?:

No, you have not made any payments, the reduction in your salary is not a payment and cannot be deducted as a private use payment.

If you are part of the OpRa Scheme, the amount you have paid in your salary sacrifice for the year is the taxable amount due on your BiK

What is the OpRa scheme?

Where employees entered into new arrangements on or after 6 April 2017, then their company car benefit will equal the greater of :

(i) the amount as calculated under standard company vehicle BIK , and

(ii) the gross salary sacrifice / gross cash allowance forgone*.

What are HMRC’s current Car Tax %?

https://www.gov.uk/guidance/company-car-benefit-the-appropriate-percentage-480-appendix-2

Estimating the Car Benefit Tax you will pay:

You can see how much tax you might pay with HMRC’s company car and fuel benefit calculator.

https://www.gov.uk/tax-company-benefits/tax-on-company-cars

I have a leased car and have claimed mileage is this taxable?

Employees who have an HSC leased car are taxed on business miles paid above HMRC’s company car mileage rates (Advisory Fuel Rates). The excess amounts paid above HMRC’s Advisory Fuel Rates are included in Section E of the P11d form.

I entered “free miles” into my travel claims. How do these appear on the P11D?

Free miles are those miles that are not reimbursed by your employer, but are considered work-related mileage by HMRC. If you claim these, they reduce the amount of the mileage benefit reported on your behalf.

If the use of free miles results in a negative benefit, a separate letter will be sent to you detailing this amount for inclusion on your self-assessment or application for tax relief.

What should I do if I receive a P11D?

You should review your P11D for accuracy and if you believe, any details are incorrect contact PSC on 02895 362190 or by webform: https://payrollquery.hscni.net/

You should keep your P11D safely as you will need this should you need to complete a Self-Assessment to HMRC.

When is Payday?

Monthly Paid: Employees are paid on the 3rd last banking day of each month.

Weekly Paid: Employees are paid each Thursday.

Fortnightly Paid: Employees are paid on the Thursday of every second week. Depending on what fortnightly frequency you are on will depend on your pay date. For Example, Fortnightly 1 employees are paid week 1,3,5,7,9 etc. and Fortnightly 2 employees are paid week 2,4,6,8 etc.

For Payroll Calendar, please see the Home Page.

What is Superannuation?

Superannuation is the amount of money you have contributed into a pension scheme within a pay period. Further information on HSCNI pension schemes can be found at :

What is SSP/OSP?

Statutory Sick Pay (SSP) is the governments minimum level of pay for employees who are absent from work due to illness

Occupational Sick pay (OSP) , sometimes known as company sick pay , is where an organisation chooses to provide a contractual sick pay arrangement that is more generous than the Statutory minimum (SSP)

These will show on your payslip if you have been absent from work due to illness. Any OSP or SSP records with an asterisk (*) beside them relate to a sickness period outside of the current pay period.

Why has my tax code changed?

Tax Codes are issued by Her Majesty’s Revenue and Customs (HMRC), in order to deduct Income Tax to take from your pay. The code is calculated by HMRC, who send it to the Payroll Service Centre (PSC) electronically. A tax code is an employee’s personal allowance which is confidential between the employee and HMRC. PSC only determine your tax code if you are a new start, documentation should be provided in the form of: a P45, P46 or Starter Checklist.

Further information on tax codes can be found on HMRC’s website:

What is a BACS advance (Off cycle payment)?

A BACS advance is an advance of money that has been submitted into your bank account. This money will also be paid in your next payslip although we have provided this directly into your bank account as an advance. As we have provided this amount as an advance of money into your bank account it will show on your payslip as a deduction.

Example:

An employee is due £300 pound in relation to Basic Pay and Overtime.

This should have been paid in January salary although missed the exit date for payroll closedown therefore will not be paid until February.

Payroll submits a BACS advance for £300 paid directly into the employee’s bank account prior to February Payday

February payday comes around and the employee see’s BACS advance deduction for £300 on their payslip. This is due to the fact the Basic pay and Overtime due will also be paid on this payslip. Effectively Payroll has paid £300 twice (Once as a BACS advance and once on February payslip) and deducted it back once (Deduction of BACS advance on February Payslip)

What is my National insurance number?

If you have lost or forgotten your NI number, you can find it on your P60, or any letters sent to you by HMRC relating to tax, pensions and benefits. PSC cannot provide your NI number as they are not the creators of this information.

If you still can’t find your NI number, you can: fill in and return a CA5403 form to HMRC which can be found on HMRC website:

Or alternatively phone the National Insurance number helpline on 0300 200 3502.

What do I need to do if I have recently changed my hours and think my pay is wrong?

Please check with your line manager first that they have submitted the appropriate paper work to payroll.

What is the Pension Band Review Protocol?

To ensure compliance with the HSC pension regulations, any employee who is a member of the HSC pension scheme is required to pay the correct percentage rate of contributions. In order to ensure this is correct, the Payroll Service Centre (PSC) must undertake an assessment of each employee’s total pensionable earnings. This is undertaken on a monthly basis and corrections made where required.

How are my earnings calculated for the Pension Band Review?

Following a change to HSC Pension Scheme Regulations on 01 November 2022 – there are two different methodologies to determine your Pensionable Pay depending on the period being assessed:

In order to establish your total Pensionable Earnings for any period prior to 31 October 2022 the following calculation is used:

Pensionable Earnings =

Whole Time Equivalent (WTE) Basic Pay

+ Prior Year’s pensionable Enhancements (not included in the calculation if there has been a change to pensionable earnings in year e.g. A Change to WTE Basic Pay or Salary Sacrifice Deduction)

– Salary Sacrifices

In order to establish your total Pensionable Earnings for the period from 01 November 2022 onwards the following calculation is used:

Pensionable Earnings =

Actual Basic Pay

+ Prior Year’s pensionable Enhancements (not included in the calculation if there has been a change to pensionable earnings in year e.g. A Change to WTE Basic Pay or Salary Sacrifice Deduction)

+ Prior Years Additional Hours (Up to WTE)

– Salary Sacrifices

How are my Pensionable earnings calculated if I have more than one post?

Prior to November 2022, all employments were treated separately in the calculation of pensionable earnings.

From 1 November 2022 the methodology for calculating pensionable earnings will combine earnings for multiple posts within the same employer.

For example:

Julie has two Part time posts within the Belfast Trust, with Pensionable Earnings of £20k in each post, prior to November 2022 these would have been treated as individual posts therefore post 1 would have been held at 5.6% and post 2 would have been held at 5.6%%, however these are now treated as a combined earning of £40k in total and therefore 9.8% rate applies in both posts.

What pension rate will I pay?

The tables below outline the Pension contributions rates used:

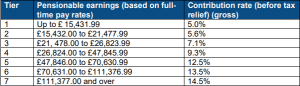

Contribution Rates April 2015 – 31 October 2022:

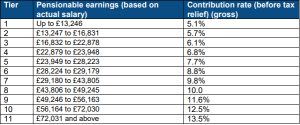

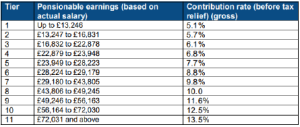

Contributions Rates 1 November 2022 – Present:

When are Pension Band Reviews completed?

There are multiple scenarios when a Pension Band Review is completed by the Payroll Service Centre (PSC). These include:

- Yearly Review (Completed end of Financial Year) – A yearly pension banding review will take place at the end of every Financial Year. This will set each employee’s pension contribution rate for the new financial year, based on the Pension Band Review methodology.

- Business As Usual In Month Review (Completed every Month) – A full assessment of every HSC Pension member’s pension contribution rate will be completed at the beginning of each month for all employees, irrespective of pay frequency. During this assessment, any changes that took place to elements of their basic pay or salary sacrifices from the previous month will be identified. For these members, their new pension contribution rate will be calculated and the system will be updated accordingly, effective from next pay period. Any new employees that joined the HSC Pension Scheme during the last month will also be assessed through this exercise. This pension contribution rate will be applied to the employee until a further change to their pensionable pay takes place. If a retrospective change is identified, the rate will be changed from the month in which it is identified and any arrears owed collected as part of the Pay Award or annual Pension Band Review Assessment.

- Pay Award Review (Completed in Pay Award) – When a retrospective pay award takes place, each member’s pensionable earnings need to be recalculated for the entire financial year. This assessment will be completed for every month that has passed between April and the implementation of the retrospective pay award.

- Retrospective Regrading’s – In instances where an employee’s pay is being changed retrospectively, a Pension Band Review for each of the periods in question would need re-assessed to ensure they are paying the correct Pension contributions for each of the periods and any arrears due collected from their salary.

Worked Examples

In Month Pension Band Review:

Michael works part time (22.5 hours) as an Admin assistant Band 3. Last year he worked some additional hours when required due to workload pressures. Due to increase in workload Michael increases his Part time hours from 22.5 to 30 from May 2023 onwards. Therefore, the calculation would be as follows for June 2023:

| Calculation | Amount | Total |

| Basic Pay | £17,384 (30 hours of £21,730 WTE) | £17,384 |

| Additional Hours 22/23 | £2,500 | £2,500 |

| Enhancements 22/23 | £0 | £0 |

| Salary Sacrifice | £0 | £0 |

| Total | £19,384 | £19,384 |

| Contribution rate | 6.1% | 6.1% from 1st June 2023 |

Pay Award Pension Band Review:

John works full-time as a Community Nurse Band 5. Due to the 2022/23 Pay Award being implemented in October 2022, John’s salary has increased by £1,400 from £25,655 to £27,055 per annum. This needs to be backdated to 1 April 2022. John also has a salary sacrifice under the cycle to work scheme and pays £100 per month for the bicycle. John’s pension contributions need reassessed back to 1 April 2022 due to the increase in salary back to that date.

Due to the change in Pension Tiers from 1 November 2022, John’s rate is set to 31/10/23 using the old methodology, and from 1/11/22 at the new rates, and using the new methodology.

Period 01/04/2022 – 31/10/2022 – Rate set using old methodology

| Calculation | Amount | Total |

| WTE Basic Pay | £27,055 (WTE band 5) | £27,055 |

| Enhancements 21/22 | £0 | £0 |

| Salary Sacrifice | £1200 (Per year) | £1200 |

| Total | £25,855 | £25,855 |

| Contribution rate | 7.1% | 7.1% |

John pays contributions at a rate of 7.1% between 01/04/2022 and 31/10/2022.

Period 01/11/2022 – 31/03/2023 – Rate set using new methodology

| Calculation | Amount | Total |

| Basic Pay | £27,055 (WTE band 5) | £27055 |

| Additional Hours 21/22 | £0 | £0 |

| Enhancements 21/22 | £0 | £0 |

| Salary Sacrifice | £1200 | £1200 |

| Total | £25,855 | £25,855 |

| Contribution rate | 7.7% | 7.7 |

John pays contributions at a rate of 7.7% between 01/011/2022 and 31/03/2023.

Impact of a Change to Pensionable Earnings

Clare works Full time as a Domiciliary Care Home Help Band 3 Lv 2. Clare is due to receive an increment on 14th July 2022 moving from a Band 3 Lv 2 (£21,730) to a Band 3 Lv 3 (£23,177). Clare has also been paid £5,500 enhancements for the previous year – these have been paid through unsocial hours, Saturday Enhancement, Sunday Enhancements and Bank Holiday Enhancement. As there has been a change to the employee pensionable earnings the previous years enhancements will now be dropped from the Pension Band Review calculation from the next pay period after the change has been made – in Clare’s case this will be August 2022.

Due to the change in Pension Tiers from 1 November 2022, Clare’s rate is set to 31/10/23 using the old methodology, and from 1/11/22 at the new rates, and using the new methodology.

Period 01/04/2022 – 31/07/2022 – Rate set using old methodology

| Calculation | Amount | Total |

| WTE Basic Pay | £21,730 (WTE Band 3 Lv 2) | £21,730 |

| Enhancements 21/22 | £5,500 | £5,500 |

| Salary Sacrifice | £0 | £0 |

| Total | £27,230 | £27,230 |

| Contribution rate | 9.3% | 9.3% |

Period 01/08/2022 – 31/10/2022 – Rate set using old methodology

| Calculation | Amount | Total |

| WTE Basic Pay | £23,177 (WTE Band 3 Lv 2) | £23,177 |

| Enhancements 21/22 | £5,500 (Dropped From Calculation) | £0 |

| Salary Sacrifice | £0 | £0 |

| Total | £23,177 | £23,177 |

| Contribution rate | 7.1% | 7.1% |

Period 01/11/2022 – 31/03/2023 – Rate set using new methodology

| Calculation | Amount | Total |

| Basic Pay | £23,177 | £23,177 |

| Additional Hours 21/22 | £0 | £0 |

| Enhancements 2122 | £5,500 (Dropped From Calculation) | £0 |

| Salary Sacrifice | £0 | £0 |

| Total | £23,177 | £23,177 |

| Contribution rate | 6.8% | 6.8% |

What is the BSO Employee Remuneration and Expenses Overpayment policy?

Form P60 Financial Year 2022-2023 FAQ

Q When will I receive my P60?

A P60s are issued by PSC in batches. They will all be issued by 31st May 2023.

Q Can I call to Payroll Service Centre and collect my P60?

A Unfortunately, the sheer volume of P60s to be issued means that we cannot hold individual P60s for collection.

Q I am on ESS. Why can I not access my P60?

A The facility to access form P60 has not been activated within HRPTS therefore only a paper copy is available and posted.

Q I need my P60 now. Why will you not give me the information on this call?

A The Payroll Service Centre is bound by the Data Protection Act. This protects the employee from potential identity theft, fraud etc. We have no way of being 100% sure of a caller’s identity, despite the measures taken to ensure security and therefore cannot risk the security of an employee’s information by releasing it over the phone.

Q My Annual Salary is £XXXXX.00 but according to my P60 I only earned £XXXXX.00. Why is there a difference?

A The figure on the P60 is Taxable Pay. This is your Annual Salary less Superannuation and Salary Sacrifice / GAYE.

Example

Band 5 Point 01: £24,907.00 per annum

Child Care Voucher: £243.00 per month = £2916.00 per annum

Cycle Scheme: £50.00 per month = £600.00 per annum

Superannuation: 24,907.00 – (2.916.00 + 600.00)

24,907.00 – 3,516.00 = 21,391.00 therefore Superannuation paid at 5.6% = £1,197.89

Taxable Pay: 24,907.00 – (2,916.00 + 600.00 + 1,197.89) = 20,193.11

Q I have more than one post but only received one P60. Why do I not get a P60 for each post?

A P60s are issued per Payment Frequency and not per post that is;

If you have more than one post but they are paid on the same frequency e.g. two Monthly paid posts, then your figures will be totalled and one P60 produced.

If you have more one post and they are paid on different frequencies e.g. one Monthly post and one Weekly post, you will receive separate P60’s for each.

Please note that if you have more than one post on the same frequency but receives more than one P60 this is an indication of a potential error with the Multiple Employment Links. These can only be corrected by HR, therefore you should contact their HR Department as soon as possible and request that the ME Links be checked. Incorrect links can cause an underpayment of Tax.

Q Why is my work address listed as Belfast City Hospital / Altnagelvin Hospital etc?

A Every Trust has a vast number of Facilities and it is not possible to reflect that level of detail on the P60. In place of the employee’s actual work address, everyone has the Headquarters of their Trust listed

Q Why have I not received my P60?

A If you have not received your P60, we would advise checking to ensure that your home address listed on HRPTS is the same as the address you currently use. We recommend regularly ensuring that your details on HRPTS are up to date.

In order for your P60 to be reissued, you need to contact your HR Department, once your details have been updated a new P60 will be issued to the correct address.

P60s will be continuously issued up to and including 31st May 2023. If you have not received a P60 by 5th June 2023 please contact us again.

Q Can you email a copy of my P60 to me?

A For security purposes, copies of P60s can only be emailed to Trust email addresses e.g. Joe.Bloggs@westerntrust.hscni.net.

They can not be emailed to personal email addresses. This is again due to the constraints of the Data Protection Act. An email address does not give us enough assurance that the correct information is being issued to the correct employee. This is why we only email to official assigned Trust email addresses.

Q I moved from one Trust to another during the year. Why are my earnings from the first Trust not on my P60?

A If there has been a change of Trust during the Financial Year then the earnings will be split on your P60. The Section marked “In this employment” will only hold the earnings for your current employer. The Section marked “In previous employment” will have the earnings from your previous employer. They will be added together in the Section marked “Total for year”

If you have come to HSC employment from a Non HSC employer, the figures from your previous employer will only appear on your P60 if you have given your P45 to Payroll Service Centre. As long as your previous employer has sent your P45 to HMRC, the figures should be on your main tax record but you will need to contact HMRC to confirm this

Pension Auto Enrollment

1. What is Pension Auto-Enrolment?

All employers must provide a workplace pension scheme whether public or private sector, this is called ‘automatic enrolment.’ Your employer must automatically enrol you into a pension scheme and make contributions to your pension if all of the following apply:

• you’re aged between 22 and state retirement age

• you earn at least £10,000 per year

• you usually (‘ordinarily’) work in the UK

This will happen when you join any HSCNI organisation automatically.

2. What Pension scheme/s will I be automatically enrolled into?

The 2 pension schemes used by HSC employees are:

• HSC Pension Scheme.

• NEST Pension

3. Why have I been put into a pension scheme?

All employers now have to put their workers into a pension scheme if they earn over £10,000 per year, are aged 22 or over and are under state pension age. This is the law, because the government wants to get more people to have another income in addition to the state pension when they retire.

4. How is it determined which pension scheme I am enrolled into?

The majority of individuals will be enrolled into an HSC pension scheme. However, you will be enrolled into NEST if the following applies:

a. You are already in receipt of a 1995 Section HSC pension.

b. You are in the HSC pension in another post up to full time, and this additional post has earnings that exceed £10K per annum.

c. You are under age 75.

5. How do I leave the scheme?

If you don’t want to join the scheme, you need to ask to leave it. You can choose to leave the scheme in the one month period from the date you were put in. You do this by completing the leaving the scheme form available from the website addresses below:

➢ HSC Pension Scheme: Leaving the Scheme – HSC Pension Service (hscni.net)

➢ NEST Pension Scheme: www.nestpensions.org.uk

Both forms should be submitted to the PSC Contact Team for action by the payroll

service centre. See link below to the Payroll Query Form.

https://payrollquery.hscni.net/

If you leave the scheme during this period any money you have already paid into

your pension may be refunded and you won’t have become a member of the scheme

on this occasion.

If you want to stop paying into your pension after the end of this one month period

you can. The money you have already put in should be refunded, however this may

vary depending upon which pension scheme you have been placed into and for how

long you have been paying into it.

6. What if I ask to leave the scheme but then change my mind in the future?

You can ask to re-join the scheme at any time by completing the relevant forms

found on the website addresses below and submitting to the following web link:

https://payrollquery.hscni.net/

HSC Pension Scheme: Joining the Scheme – HSC Pension Service (hscni.net)

NEST Pension Scheme: www.nestpensions.org.uk

7. If I ask to leave the scheme, what happens after that?

Anyone who asks to leave, or stops paying into, the scheme will be put back into it at

a later date (usually every three years if they meet certain criteria) in line with the

rules of pension auto re-enrolment. We will contact you when this happens and if

you wish you can ask to leave the scheme again as set out in the questions above.

8. If I stay in the scheme what % of pension will I pay?

You will pay a % of your pensionable earnings each pay period. This varies

depending on the scheme you have been enrolled into. See the tables below for

both schemes and the relevant earnings thresholds for each of the pension

contribution tiers.

If you are enrolled into the HSC Scheme, your % of contribution will be reassessed

on a monthly basis in line with all other HSC employees.

HSC Pension Scheme

Contributions Rates 1 November 2022 – Present:

The employer contribution rate for all HSC schemes is currently held at 22.5%.

NEST Pension Scheme

The rates payable for the NEST Pension Scheme are set and do not fluctuate with earnings.

| NEST | Employee Contribution rate | Employer Contribution rate |

| 5% | 3% |

Pension Re-enrolment

9. What is Pension Re-enrolment?

Whilst employees will be auto enrolled into a Pension scheme upon joining a HSCNI organisation, they may choose to opt out, as covered in Questions 1-8.

There is a legal obligation of the employer to re-enrol employees to the pension scheme after a 3-year period. As this is a legal requirement, PSC will undertake this work in line with requirements and you will be advised when this happens by letter.

10. How often does this happen?

This happens every 3 years within a 6-month date range stipulated to each employer by the Pension Regulator. This will vary from employer to employer even across each of the HSC employing organisations.

11. Who will be assessed?

Any employees who are not an active member of a pension scheme at the date of assessment. The criteria in which you will be are assessed is the same as auto-enrolment. These are:

• you’re aged between 22 and state retirement age

• you earn at least £10,000 per year

• you usually (‘ordinarily’) work in the UK

12. Will anyone be excluded from the being re-enrolled?

Yes, there are specific circumstances when employees will not be re-enrolled to a pension scheme as below:

a) The employee has opted out of the pension scheme within 12 months prior to the date of assessment.

b) The employee is absent from employment due to sickness on the date of assessment.

c) The employee does not meet the criteria as set out in question 11.

13. How is it determined which pension scheme I am enrolled into?

The majority of individuals will be enrolled into an HSC pension scheme. However, you will be enrolled into NEST if the following applies:

a) You are already in receipt of a 1995 Section HSC pension.

b) You are in the HSC pension in another post up to full time, and this additional post has earnings that exceed £10K per annum.

c) You are under age 75.

14. How do I leave the scheme?

If you don’t want to join the scheme, you need to ask to leave it. You can choose to leave the scheme in the one month period starting on either the date of the letter received from the PSC to advise of your re-enrolment, or the date you were put into the scheme, whichever is the latest. You do this by completing the Leaving the Scheme form available from the website addresses below:

HSC Pension Scheme: Leaving the Scheme – HSC Pension Service (hscni.net)

NEST Pension Scheme: www.nestpensions.org.uk

Both forms should be submitted to the PSC Contact Team, using the Payroll Query Form for action by the payroll service centre.

https://payrollquery.hscni.net/

If you leave the scheme during this period any money you have already paid into your pension may be refunded and you won’t have become a member of the scheme on this occasion.

If you want to stop paying into your pension after the end of this one month period you can. The money you have already put in should be refunded, however this may vary depending upon which pension scheme you have been placed into and for how long you have been paying into it.

15. What if I ask to leave the scheme but then change my mind in the future?

You can ask to re-join the scheme at any time by completing the relevant forms found on the website addresses below and submitting to the following web link https://payrollquery.hscni.net/

HSC Pension Scheme: Joining the Scheme – HSC Pension Service (hscni.net)

NEST Pension Scheme: www.nestpensions.org.uk

16. If I ask to leave the scheme, what happens after that?

This cycle of re-enrolment continues to happen every 3 years while you are an employee and meet the criteria of re-enrolment.

Business Services Organisation

Business Services Organisation