To ensure compliance with the HSC pension regulations, any employee who is a member of the HSC pension scheme is required to pay the correct percentage rate of contributions. In order to ensure this is correct, the Payroll Service Centre (PSC) must undertake an assessment of each employee’s total pensionable earnings. This is undertaken on a monthly basis and corrections made where required.

How are my earnings calculated for the Pension Band Review?

Following a change to HSC Pension Scheme Regulations on 01 November 2022 – there are two different methodologies to determine your Pensionable Pay depending on the period being assessed:

In order to establish your total Pensionable Earnings for any period prior to 31 October 2022 the following calculation is used:

Pensionable Earnings =

Whole Time Equivalent (WTE) Basic Pay

+ Prior Year’s pensionable Enhancements (not included in the calculation if there has been a change to pensionable earnings in year e.g. A Change to WTE Basic Pay or Salary Sacrifice Deduction)

– Salary Sacrifices

In order to establish your total Pensionable Earnings for the period from 01 November 2022 onwards the following calculation is used:

Pensionable Earnings =

Actual Basic Pay

+ Prior Year’s pensionable Enhancements (not included in the calculation if there has been a change to pensionable earnings in year e.g. A Change to WTE Basic Pay or Salary Sacrifice Deduction)

+ Prior Years Additional Hours (Up to WTE)

– Salary Sacrifices

How are my Pensionable earnings calculated if I have more than one post?

Prior to November 2022, all employments were treated separately in the calculation of pensionable earnings.

From 1 November 2022 the methodology for calculating pensionable earnings will combine earnings for multiple posts within the same employer.

For example:

Julie has two Part time posts within the Belfast Trust, with Pensionable Earnings of £20k in each post, prior to November 2022 these would have been treated as individual posts therefore post 1 would have been held at 5.6% and post 2 would have been held at 5.6%%, however these are now treated as a combined earning of £40k in total and therefore 9.8% rate applies in both posts.

What pension rate will I pay?

The tables below outline the Pension contributions rates used:

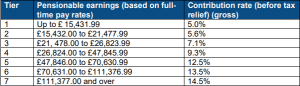

Contribution Rates April 2015 – 31 October 2022:

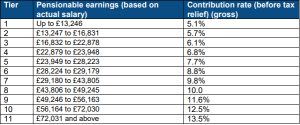

Contributions Rates 1 November 2022 – Present:

When are Pension Band Reviews completed?

There are multiple scenarios when a Pension Band Review is completed by the Payroll Service Centre (PSC). These include:

- Yearly Review (Completed end of Financial Year) – A yearly pension banding review will take place at the end of every Financial Year. This will set each employee’s pension contribution rate for the new financial year, based on the Pension Band Review methodology.

- Business As Usual In Month Review (Completed every Month) – A full assessment of every HSC Pension member’s pension contribution rate will be completed at the beginning of each month for all employees, irrespective of pay frequency. During this assessment, any changes that took place to elements of their basic pay or salary sacrifices from the previous month will be identified. For these members, their new pension contribution rate will be calculated and the system will be updated accordingly, effective from next pay period. Any new employees that joined the HSC Pension Scheme during the last month will also be assessed through this exercise. This pension contribution rate will be applied to the employee until a further change to their pensionable pay takes place. If a retrospective change is identified, the rate will be changed from the month in which it is identified and any arrears owed collected as part of the Pay Award or annual Pension Band Review Assessment.

- Pay Award Review (Completed in Pay Award) – When a retrospective pay award takes place, each member’s pensionable earnings need to be recalculated for the entire financial year. This assessment will be completed for every month that has passed between April and the implementation of the retrospective pay award.

- Retrospective Regrading’s – In instances where an employee’s pay is being changed retrospectively, a Pension Band Review for each of the periods in question would need re-assessed to ensure they are paying the correct Pension contributions for each of the periods and any arrears due collected from their salary.

Worked Examples

In Month Pension Band Review:

Michael works part time (22.5 hours) as an Admin assistant Band 3. Last year he worked some additional hours when required due to workload pressures. Due to increase in workload Michael increases his Part time hours from 22.5 to 30 from May 2023 onwards. Therefore, the calculation would be as follows for June 2023:

| Calculation | Amount | Total |

| Basic Pay | £17,384 (30 hours of £21,730 WTE) | £17,384 |

| Additional Hours 22/23 | £2,500 | £2,500 |

| Enhancements 22/23 | £0 | £0 |

| Salary Sacrifice | £0 | £0 |

| Total | £19,384 | £19,384 |

| Contribution rate | 6.1% | 6.1% from 1st June 2023 |

Pay Award Pension Band Review:

John works full-time as a Community Nurse Band 5. Due to the 2022/23 Pay Award being implemented in October 2022, John’s salary has increased by £1,400 from £25,655 to £27,055 per annum. This needs to be backdated to 1 April 2022. John also has a salary sacrifice under the cycle to work scheme and pays £100 per month for the bicycle. John’s pension contributions need reassessed back to 1 April 2022 due to the increase in salary back to that date.

Due to the change in Pension Tiers from 1 November 2022, John’s rate is set to 31/10/23 using the old methodology, and from 1/11/22 at the new rates, and using the new methodology.

Period 01/04/2022 – 31/10/2022 – Rate set using old methodology

| Calculation | Amount | Total |

| WTE Basic Pay | £27,055 (WTE band 5) | £27,055 |

| Enhancements 21/22 | £0 | £0 |

| Salary Sacrifice | £1200 (Per year) | £1200 |

| Total | £25,855 | £25,855 |

| Contribution rate | 7.1% | 7.1% |

John pays contributions at a rate of 7.1% between 01/04/2022 and 31/10/2022.

Period 01/11/2022 – 31/03/2023 – Rate set using new methodology

| Calculation | Amount | Total |

| Basic Pay | £27,055 (WTE band 5) | £27055 |

| Additional Hours 21/22 | £0 | £0 |

| Enhancements 21/22 | £0 | £0 |

| Salary Sacrifice | £1200 | £1200 |

| Total | £25,855 | £25,855 |

| Contribution rate | 7.7% | 7.7 |

John pays contributions at a rate of 7.7% between 01/011/2022 and 31/03/2023.

Impact of a Change to Pensionable Earnings

Clare works Full time as a Domiciliary Care Home Help Band 3 Lv 2. Clare is due to receive an increment on 14th July 2022 moving from a Band 3 Lv 2 (£21,730) to a Band 3 Lv 3 (£23,177). Clare has also been paid £5,500 enhancements for the previous year – these have been paid through unsocial hours, Saturday Enhancement, Sunday Enhancements and Bank Holiday Enhancement. As there has been a change to the employee pensionable earnings the previous years enhancements will now be dropped from the Pension Band Review calculation from the next pay period after the change has been made – in Clare’s case this will be August 2022.

Due to the change in Pension Tiers from 1 November 2022, Clare’s rate is set to 31/10/23 using the old methodology, and from 1/11/22 at the new rates, and using the new methodology.

Period 01/04/2022 – 31/07/2022 – Rate set using old methodology

| Calculation | Amount | Total |

| WTE Basic Pay | £21,730 (WTE Band 3 Lv 2) | £21,730 |

| Enhancements 21/22 | £5,500 | £5,500 |

| Salary Sacrifice | £0 | £0 |

| Total | £27,230 | £27,230 |

| Contribution rate | 9.3% | 9.3% |

Period 01/08/2022 – 31/10/2022 – Rate set using old methodology

| Calculation | Amount | Total |

| WTE Basic Pay | £23,177 (WTE Band 3 Lv 2) | £23,177 |

| Enhancements 21/22 | £5,500 (Dropped From Calculation) | £0 |

| Salary Sacrifice | £0 | £0 |

| Total | £23,177 | £23,177 |

| Contribution rate | 7.1% | 7.1% |

Period 01/11/2022 – 31/03/2023 – Rate set using new methodology

| Calculation | Amount | Total |

| Basic Pay | £23,177 | £23,177 |

| Additional Hours 21/22 | £0 | £0 |

| Enhancements 2122 | £5,500 (Dropped From Calculation) | £0 |

| Salary Sacrifice | £0 | £0 |

| Total | £23,177 | £23,177 |

| Contribution rate | 6.8% | 6.8% |

Business Services Organisation

Business Services Organisation