In line with circular references:

• HSC (AfC) (5) 2024

• HSC(F) 14-2024

Payroll Service Centre will be implementing these changes during May 2025

Find below a breakdown of changes to travel reimbursement.

AFC Staff (effective from 01.04.2024 )

- For AFC the existing primary rate of 56 pence per mile is to be uplifted to 58 pence per mile, while the existing secondary rate of 20 pence per mile is to be uplifted to 30 pence per mile.

- The primary rate (of 58 pence per mile) should be paid for the first 4500 miles and the secondary rate (of 30 pence per mile) should be paid thereafter.

- Public transport rates are to be uplifted from 28 pence per mile to 30 pence per mile, as advised by the Department of Health.

Prior to these changes being implemented employees who travelled above the initial threshold will have received 20p per mile, plus a manual adjustment (for 10p top-ups).

Non-Executive Directors

- In addition, the rates due to Non-Executive Directors will also be amended, with two changes effective from 01.07.2024 and 01.11.2024. The threshold will also change from 3500 to 4500miles, as per the following points.

- Non-Executive Directors are to remain at 56 pence per mile from 01.04.2024 until 30.06.2024 receiving 56 pence per mile up to a new mileage threshold of 4500 miles instead of 3500, the secondary rate (of 20 pence per mile) should be paid thereafter.

- Non-Executive Directors between 01.07.2024 to 31.10.2024.are to receive 59 pence per mile up to 4500 miles, with a new secondary rate of 24 pence per mile should be paid thereafter.

- Finally, Non-Executive Directors from the 01.11.2024 are to receive 58 pence per mile up to 4500 miles, the secondary rate of 30 pence per mile should be paid thereafter.

As part of this change from the 1st April 2024, we needed to remove 10p tops, that occurred in the financial period 1st April 2024 to 31st March 2025. What that means now is that that those Monthly, Weekly and Fortnightly staff who have claimed mileage from April 1st 2024 (Paid at 30 pence per mile) will have had some manual adjustments made to their payments to remove these top-ups. This is because the payroll system will now have transacted these and created a retrospective payment to the employee.

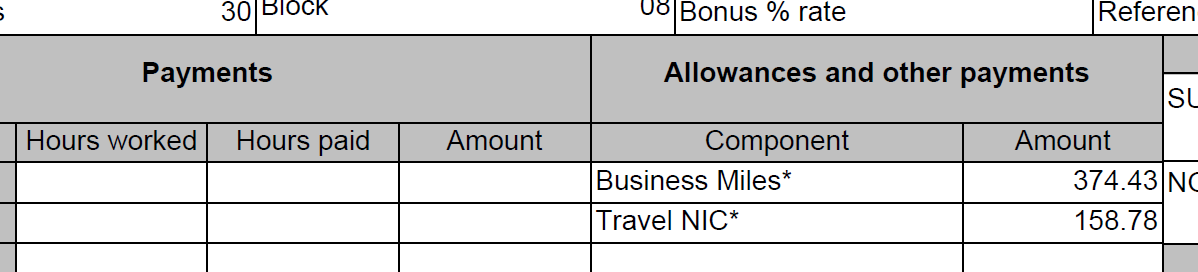

Example of Travel Uplift Arrears

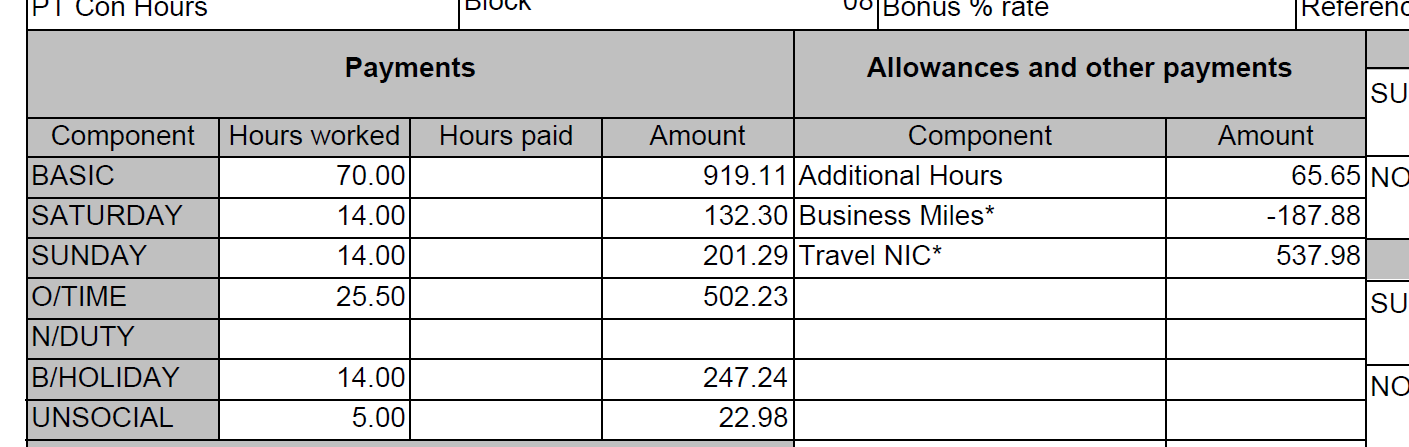

Or, you may see a negative value as shown below, however, please be assured you have been paid travel arrears, this is an adjustment for the recoupment of previously paid 10p top ups.

Business Services Organisation

Business Services Organisation